unemployment tax refund august 2021

This isnt the refund amount. More the IRS says are on the way.

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

The IRS breaks it down.

. Tax says many people who are finally getting their unemployment-related tax refunds are getting overpayments. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Facebook Twitter LinkedIn Reddit Print.

Is IRS Pulling Test Batch. The IRS will determine the correct taxable amount of unemployment compensation and. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year.

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year. The 10200 amount 20400 for joint filers is how much 2020 unemployment compensation doesnt count as income. Those refunds are supposed to keep coming through the end of summer.

Irs unemployment tax refund august update. Im still waiting for my 2020 unemployment refund. They have been going over returns that paid taxes on unemployment benefits before the law.

The IRS is set to send 15 million refunds alon. 0 1 minute read. People who received unemployment benefits last year and filed tax.

Unpaid child support could also keep you from getting the money. So far the IRS has gone through four rounds of refunds due to the unemployment compensation exclusion. 20 minutes agoThe first went into effect with the start of the current fiscal year in July 2021 while the two remaining hikes will come the next two Julys.

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. The most recent batch of unemployment refunds went out in late july 2021. When will I get my unemployment tax refund.

The next phase of unemployment refunds will be issued on Wednesday August 18th. Already filed a tax return and did not claim the unemployment exclusion. 1031 Exchange Rules 2020.

TAS Tax Tip. The IRS has already sent out 87 million. Like all tax refunds it can be seized if you have unpaid taxes outstanding federal or state.

Refunds by direct deposit started in late July. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Sadly you cant track the cash in the way.

So far the IRS has sent about 87 million unemployment-related refunds beginning in. If your modified adjusted gross income is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200 The IRS states on its website. The Department of Labor has not designated their state as a credit.

IRS Standard Mileage Rates 2021. 4 days ago. Around 540000 minnesotans can expect to get a tax refund with the first 1000 payments going out this week.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations. So far the IRS has issued nearly 9 million unemployment compensation refunds totaling more than 10 billion. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

Paper check refunds start in early August. However the irs has not yet announced a date for august payments. The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that.

Unemployment benefits tax refund By Terry Savage on August 08 2021 Wild Card Pandemic Related Any idea how to find out about IRS automatically refunding for unemployment benefits originally included on 2020 tax return and taxed accordingly. So far 87 million have been identified and this number is only going to go higher. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

To keep the fund solvent before the tax hikes went into effect New Jersey began taking loans from the federal government in August 2020. To find out if you are included in this phase of unemployment refunds. Not all of the adjustments will result in refunds.

Originally started by John Dundon an Enrolled Agent who represents people. I got my 2021 tax refund in like a week though lol. The IRS is continuing with its post COVID-19 initiatives and the unemployment refunds are set to arrive for the public in August.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax. The IRS has already sent out 87 million.

One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. They fully paid and paid their state unemployment taxes on time.

The unemployment refund is a refund for those that overpaid taxes on their 2020 unemployment. More unemployment tax refunds coming irs says. As of late last month the average payment size reported by the IRS was 1686.

The refunds which were first announced in March are the result of changes authorized by the American Rescue Plan Act which excluded up to 10200 in taxable income for people who collected. It has said the. 3rd stimulus check status.

IR-2021-159 July 28 2021. So far the IRS has sent about 87 million unemployment-related refunds beginning in late May. Its borrowed more than 1 billion so far.

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. An estimated 13 million taxpayers are due unemployment compensation tax refunds. Turning Someone in for Tax Evasion.

The American Rescue Plan made it so that up to 10200 20400 for married couples filing jointly of unemployment benefit received in 2020 are tax exempt from federal income tax.

Watch Irs To Send More Unemployment Tax Refund Checks

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How The Corona Virus Affects Your Tax Return

Irs Tax Refund Delays Persist For Months For Some Americans 6abc Philadelphia

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Tax Forms For Your 2021 Tax Return

Newsletter Foreign Law Investments Luther Rechtsanwaltsgesellschaft Mbh

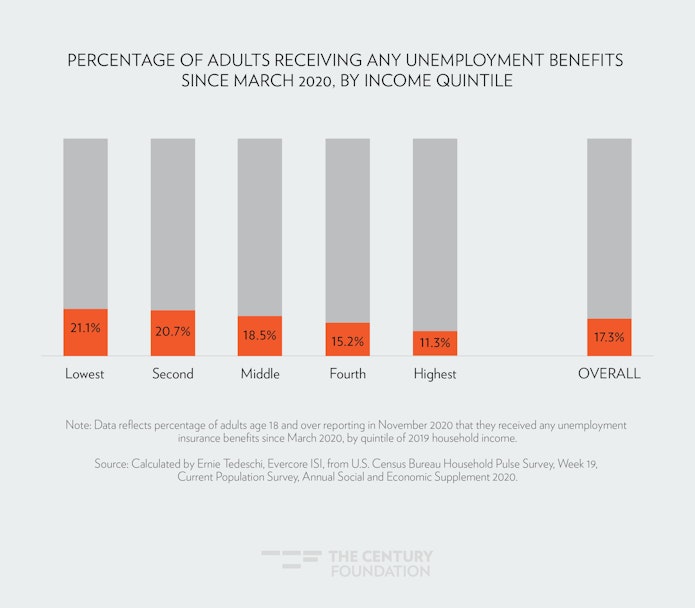

The Case For Forgiving Taxes On Pandemic Unemployment Aid

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Irs Refund Status Unemployment Refunds Coming Soon Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog